How Property Tax Prorations Affect Your Real Estate Closing in Vermont

When navigating the complex world of real estate transactions in Vermont, one of the critical elements buyers and sellers must understand is the property tax proration. This concept plays a pivotal role in ensuring a fair and equitable distribution of property taxes at the time of closing. In this post, we'll delve into the purpose of tax proration, how it's calculated, who pays, and when it's due.

What is the Purpose of the Property Tax Proration?

Property tax proration refers to the allocation of property tax liabilities between the buyer and seller based on the period each party owns the property during the tax year. The primary purpose of tax proration is to ensure that each party is responsible for covering the property taxes for the exact time they hold ownership of the property. This approach prevents any unjust enrichment, ensuring neither the buyer nor the seller pays more than their fair share of the annual property taxes.

How is Property the Tax Proration Calculated?

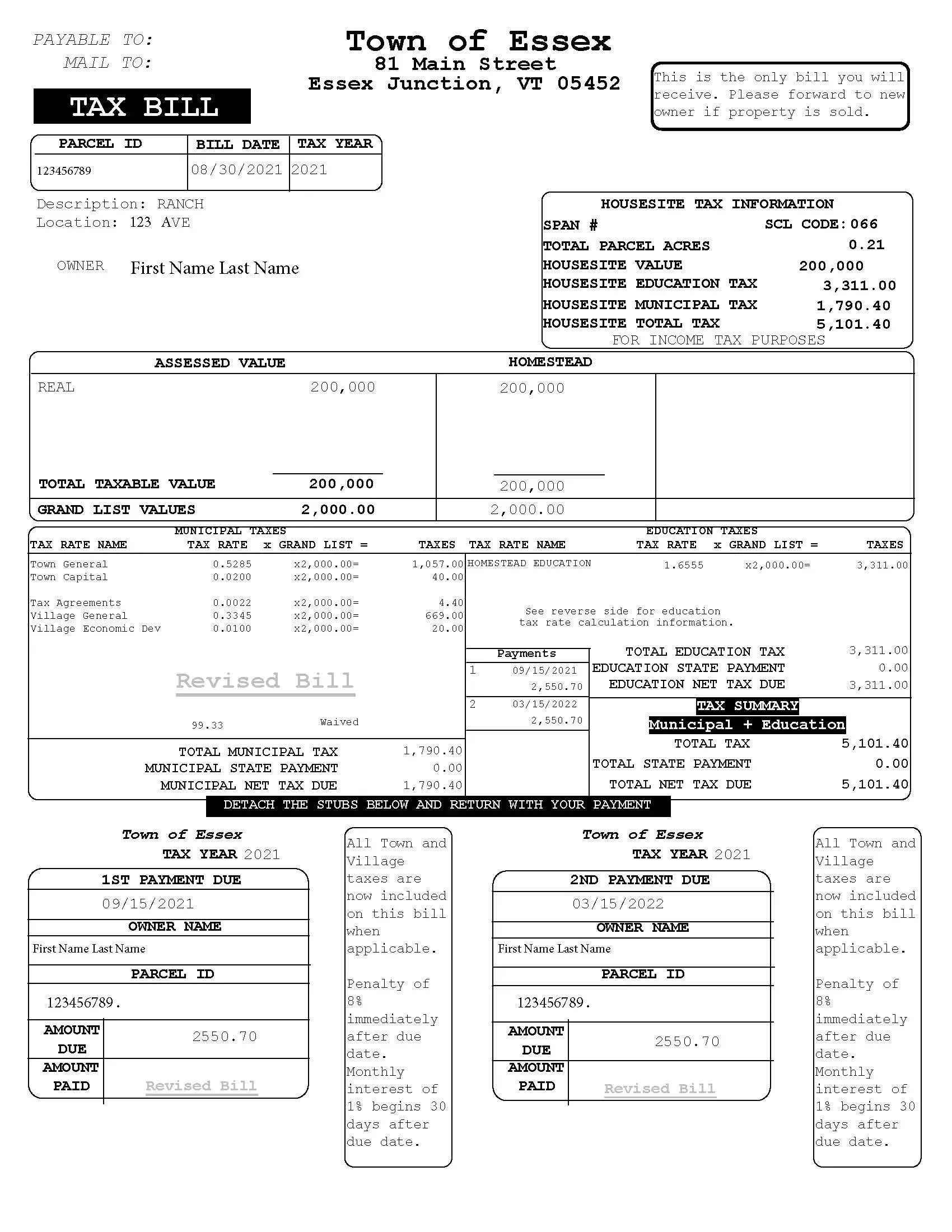

If property taxes are paid annually, the calculation of the proration is relatively straightforward. The process involves dividing the total annual property taxes by 365 days to determine a daily tax rate. This daily rate is then multiplied by the number of days the seller has owned the property during the current tax year up to the closing date. If the taxes are due in more than one installment, the same approach is used for the shorter periods covered by each installment.

For example, if the annual property taxes are $3,650 and the seller has owned the property for 120 days by the closing date, the daily tax rate would be $10 ($3,650 ÷ 365). The seller's prorated tax liability would then be $1,200 ($10 × 120 days), which the seller credits to the buyer at closing. The buyer would then pay the bill in full when it becomes due later in the year.

Who Pays the Prorated Tax?

Typically, the seller is responsible for the property tax up until the day of closing. The buyer then assumes responsibility from the closing date forward. If the tax installment is due after the closing, the seller will credit the buyer with the prorated amount of taxes for the part of the year the seller owned the property. If the tax installment was paid by the seller before the closing, the buyer will credit the seller with the prorated amount of taxes for the part of the year the buyer will own the property. These adjustments ensure that buyers and sellers are not unduly burdened with a full year's property taxes when they have not owned the property for the entire tax year.

When is the Prorated Tax Due?

The prorated tax amount is usually settled at the real estate closing. The exact due date can vary, as property tax due dates differ from one Vermont municipality to another. However, the proration is calculated based on the property's closing date, regardless of the specific due dates for property tax payments in the area where the property is located.

It's important for both buyers and sellers to understand that while the prorated tax is typically settled at closing, the actual payment of property taxes to the municipality may occur at a later or earlier date, depending on local tax schedules.

Conclusion

Property tax proration is a vital aspect of real estate closings in Vermont, ensuring a fair allocation of tax responsibilities between buyers and sellers. By understanding how the tax proration works, parties involved in real estate transactions can navigate the process more smoothly and avoid potential disputes. As always, consulting with a knowledgeable Vermont transactional real estate law firm can provide invaluable guidance and ensure compliance with all legal requirements during the closing process.

By keeping these key points in mind, buyers and sellers can ensure a more transparent, equitable, and efficient closing process, paving the way for a successful real estate transaction in Vermont.

For more questions regarding property taxes or Vermont real estate closings, feel free to contact the Peet Law Group at https://www.peetlaw.com/.