Effective August 1, 2024, There will be a Significant Property Transfer Tax Increase for Vermont's Second Home Buyers and a Decrease for Most Purchasers of Primary Residences.

As of August 1, 2024, significant amendments to the Vermont property transfer tax will come into effect, altering the landscape for buyers in the residential real estate market. Understanding these changes is crucial for anyone involved in property transactions in Vermont. Here’s a detailed breakdown of what you need to know about the new law:

Key Changes to the Property Transfer Tax

1. Increased Tax Rate for Second Homes:

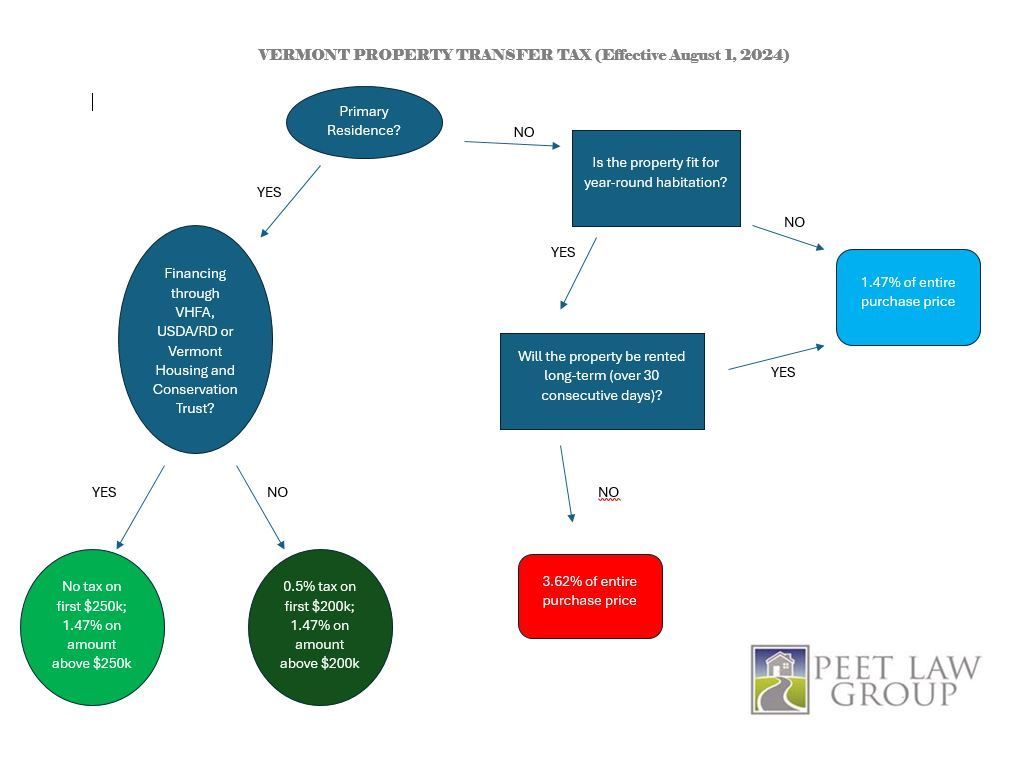

For some properties, there will be a new 3.62% transfer tax rate. In order for the 3.62% rate to apply, the property must meet all of the following criteria: (a) it must be residential property that is fit for habitation on a year-round basis; (b) that will not be used as the buyer's primary residence; and (c) the buyer will not be required to file a landlord certificate. The landlord certificate is the certificate that must be filed with the Vermont Department of Taxes in order for a tenant to claim the Renter's Rebate on their taxes. Landlords are required to file a certificate if they rent the property for a period of 30 consecutive days or more.

The increased rate of 3.62% does NOT apply to all non-primary residence properties. Notably, purchases of unimproved land, seasonal camps, commercial properties, and, most notably, long-term residential rental properties, will be taxed at a rate of 1.47%.

2. Adjustments for Principal Residences:

For properties intended to be used as the buyer’s principal residence, there are notable benefits:

- The transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold.

- For values exceeding $200,000, the tax rate will be 1.47%. This rate includes the increased clean water surcharge.

Moreover, if the purchaser secures a purchase money mortgage partially funded by a homeland grant through the Vermont Housing and Conservation Trust Fund, or if financing is obtained through the Vermont Housing and Finance Agency (VHFA) or the U.S. Department of Agriculture and Rural Development, the first $250,000 of the property's value will be exempt from the transfer tax. Beyond this amount, the rate of 1.47% applies.

3. Clean Water Surcharges:

The clean water surcharge, previously set at 0.2%, has been increased to 0.22%. This surcharge applies to the value of the property exceeding the new $200,000 principal residence thresholds mentioned above. However, principal residences benefiting from the aforementioned financing options will be exempt from this surcharge up to the initial $250,000 value.

Understanding the Implications

For buyers and sellers, these changes present both opportunities and challenges:

- Buyers of Non-Homestead Residential Properties: The significant increase in the transfer tax rate makes it essential to factor in these additional costs when planning your purchase. The increased tax can have a substantial impact on your overall investment.

- Buyers of Principal Residences: The raised threshold for lower tax rates and exemptions offers substantial savings, particularly for those utilizing specific financing options.

- Sellers: Understanding these changes allows you to better position your property in the market, particularly if targeting buyers who may benefit from the new tax structure.

Conclusion

The amendments to the Vermont property transfer tax represent a significant shift in the real estate market. Whether you are a buyer or a seller, staying informed and consulting with a real estate attorney can help you navigate these changes effectively. If you have any questions or need assistance with your property transactions, feel free to contact our office. We are here to help you make the most informed decisions in this evolving landscape.