The Closing Disclosure is one of the most important documents at a real estate closing.

Buying or selling a home can be an exciting and nerve-wracking experience, filled with many important documents and decisions. One of the most important documents at a real estate closing is the closing disclosure. In this blog post, we will explain what a closing disclosure is and why it is such a crucial document.

What is a Closing Disclosure?

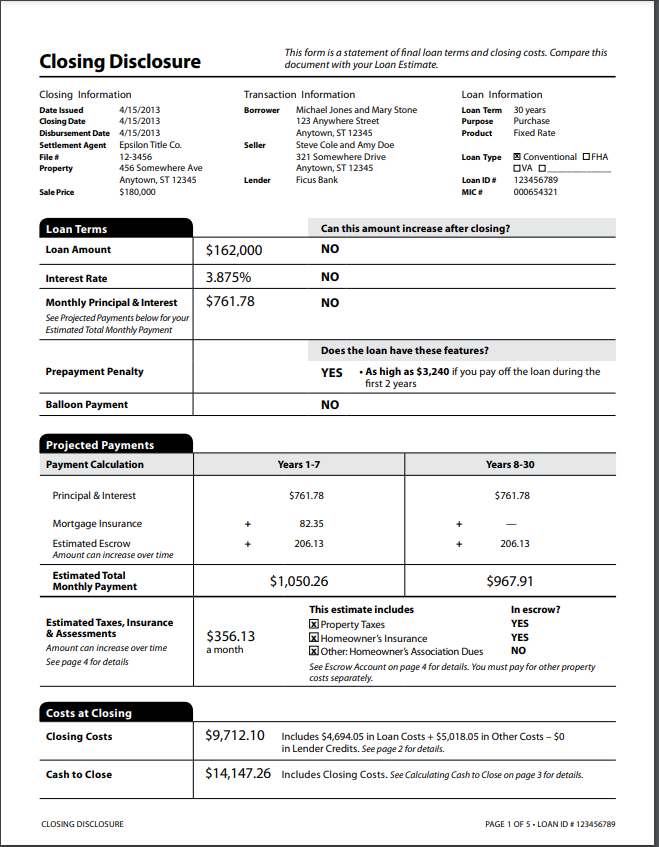

A closing disclosure is a document that outlines the final terms and costs of a real estate transaction. It is provided by the lender and must be given to the buyer at least three days before the closing. The purpose of the closing disclosure is to provide transparency and clarity to both the buyer and the seller regarding the financial aspects of the transaction.

The closing disclosure includes detailed information about the loan, such as the loan amount, interest rate, and monthly payment, as well as information about any other costs or fees associated with the transaction. These fees may include closing costs, prepaid taxes and insurance, and title fees. The closing disclosure should closely match the loan estimate that was provided to the borrower earlier in the process, but with the final numbers and any adjustments.

Why is the Closing Disclosure Important?

The closing disclosure is one of the most important documents at a real estate closing for several reasons:

1. Accuracy: The closing disclosure ensures that all of the costs and fees associated with the transaction are accurately represented. By reviewing the closing disclosure, buyers and sellers can ensure that they are not being overcharged for any fees or costs.

2. Transparency: The closing disclosure provides transparency about the costs associated with the transaction, which helps to avoid any surprises at the closing table.

3. Review: The closing disclosure gives buyers and sellers time to review and understand the final costs and fees associated with the transaction, which may help them to negotiate any necessary changes before the closing.

4. Protection: The closing disclosure protects the borrower from any unexpected fees or costs that were not disclosed earlier in the process. If there are any discrepancies between the closing disclosure and the loan estimate, the borrower has the right to question or challenge them.

In short, the closing disclosure is an essential document that provides transparency and accuracy about the final terms and costs of a real estate transaction. It is crucial for both buyers and sellers to carefully review and understand this document before signing it to ensure that everything is accurate and in line with their expectations. So, if you're planning to buy or sell a property, make sure to pay close attention to the closing disclosure – it could make all the difference in ensuring a smooth and successful transaction.