Start Fresh: New Year's Resolutions for Home Buyers

Buying a home is a major financial commitment, so start by getting your finances in order:

• Review your credit score and credit report. Address any errors or areas for improvement.

• Calculate your debt-to-income ratio to determine your borrowing capacity.

• Build or maintain an emergency fund to cover unexpected expenses.

A clear budget can help you understand how much house you can afford. To prepare:

• Determine your target down payment amount, typically 10-20% of the home’s purchase price.

• Factor in additional costs such as closing fees, property taxes, and homeowners insurance.

• Automate your savings to build your down payment fund consistently.

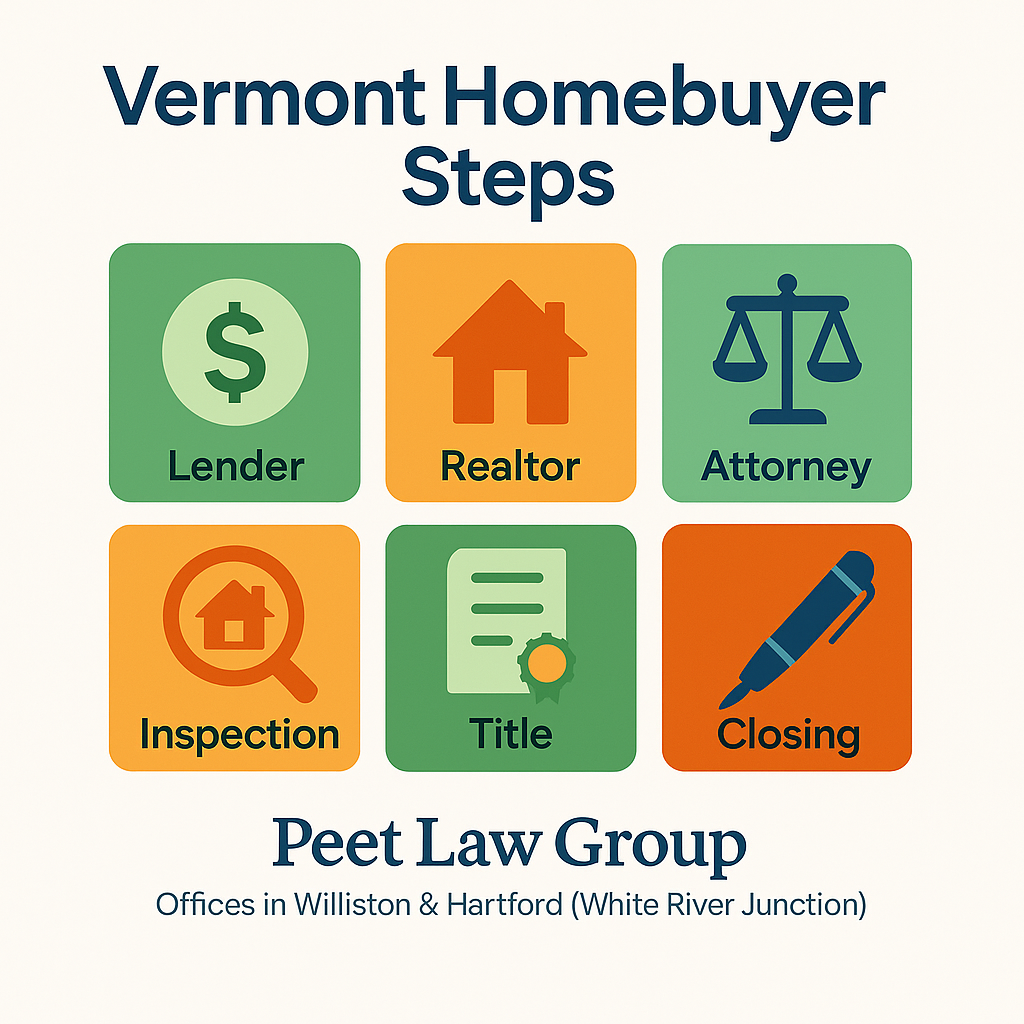

A mortgage pre-approval strengthens your buying power and shows sellers you’re serious. To get started:

• Research lenders and compare mortgage rates and terms.

• Gather necessary documentation, such as tax returns, pay stubs, and bank statements.

• Understand the differences between fixed-rate and adjustable-rate mortgages to choose the best fit for your situation.

Make a list of your must-haves and nice-to-haves to narrow down your search. Consider factors such as:

• Location: Proximity to work, schools, and amenities.

• Size: The number of bedrooms, bathrooms, and overall square footage.

• Features: A backyard, energy efficiency, or specific architectural styles.

Partnering with a knowledgeable real estate agent is invaluable when navigating the housing market. They can:

• Provide insights into market trends and neighborhood options.

• Help you find homes that match your criteria.

• Negotiate offers and guide you through the purchase process.

A real estate attorney is an essential part of the home-buying process, especially in Vermont. They can:

• Review and explain purchase agreements, mortgage documents, and other legal paperwork.

• Conduct a title search to ensure there are no legal issues with the property.

• Assist with closing procedures to ensure all transactions are legally sound.

Buying a home is an exciting milestone, but it requires careful planning and dedication. By tackling these New Year’s resolution tasks now, you’ll set yourself up for a smooth and rewarding home-buying experience.